Taxation

Taxation

Taxation in Cyprus

Taxation in Cyprus is a key aspect of living and doing business on the island. Understanding the tax system can help you make informed financial decisions.

Income Tax

In Cyprus, individuals are subject to income tax on their worldwide income if they are residents. Non-residents are taxed only on income earned in Cyprus. The tax rates are progressive, ranging from 0% to 35%.

Corporate Tax

Cyprus offers a competitive corporate tax rate of 12.5%, one of the lowest in the European Union. This low rate makes Cyprus an attractive destination for businesses. Companies are taxed on their worldwide income if they are managed and controlled in Cyprus.

Value Added Tax (VAT)

The standard VAT rate in Cyprus is 19%. However, there are reduced rates of 9% and 5% for certain goods and services. Some items, like medical supplies and books, may be exempt from VAT.

Special Defence Contribution

The Special Defence Contribution (SDC) is a tax on certain types of income, such as dividends, interest, and rental income. The rates vary, with dividends taxed at 17%, interest at 30%, and rental income at 3%.

Double Taxation Treaties

Cyprus has signed double taxation treaties with many countries. These treaties prevent individuals and businesses from being taxed twice on the same income. They also provide clarity on which country has the right to tax specific types of income.

Conclusion

Understanding taxation in Cyprus is crucial for both residents and businesses. The island offers attractive tax rates and a comprehensive network of double taxation treaties, making it a favorable location for financial planning and business operations.

Blog Posts with the term: Taxation

The article outlines significant tax changes in Cyprus for 2024, including adjustments to individual income tax brackets and exemptions, corporate tax reforms, social insurance contributions, capital gains tax rules, land transfer fees, stamp duty rates, special defence contribution updates, VAT...

The article provides an overview of Cyprus tax law for companies in 2024, highlighting competitive corporate tax rates, special defense contributions on passive income, capital gains tax adjustments, and the benefits of double taxation agreements. It also emphasizes the importance...

Cyprus is an attractive destination for dividend investors due to its low tax rates, extensive double tax treaties, and various exemptions. Understanding the rules and benefits of Cyprus' dividend taxation can help investors optimize their returns while ensuring compliance with...

The article provides an overview of the tax implications for rental income in Cyprus, distinguishing between short-term and long-term rentals. It covers key aspects such as income tax rates, GESY contributions, VAT obligations, and special defence contribution (SDC) requirements to...

Cyprus offers a favorable tax environment for stock investors, featuring low corporate tax rates, extensive double taxation treaties, and exemptions on capital gains from stocks. Understanding the basic principles of Cyprus' tax system—including corporate taxes, dividend income rules, and Special...

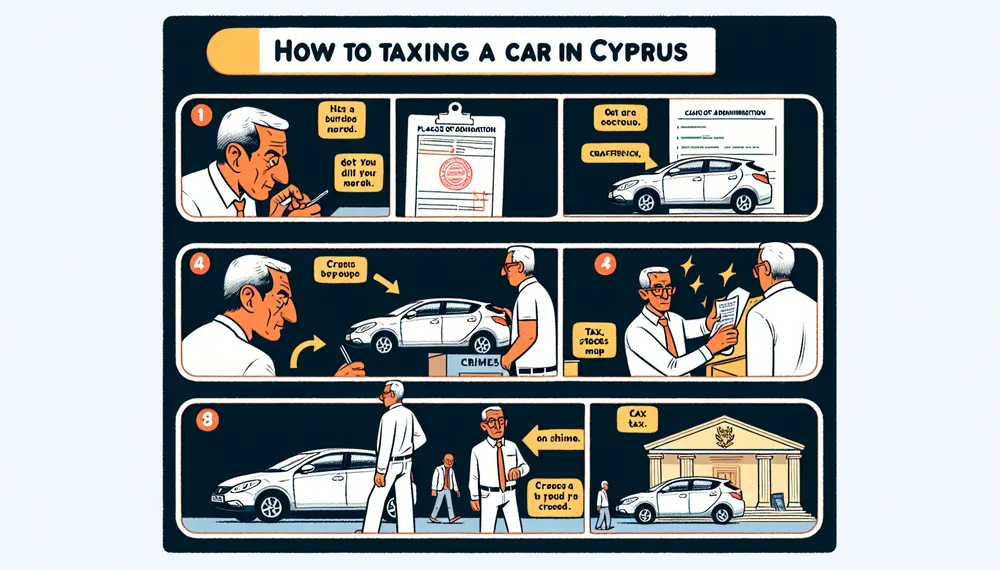

The article provides a comprehensive guide on how to tax your car in Cyprus, detailing the necessary documents, factors influencing tax calculation such as engine size and emissions, and various payment methods including online options. It aims to simplify the...

Cyprus is uniquely divided into the internationally recognized Republic of Cyprus in the south and the Turkish Republic of Northern Cyprus, only acknowledged by Turkey. This division reflects contrasting political systems, cultures, and economies while preserving distinct identities shaped by...

The Cyprus tax slab system features progressive rates, a zero-tax threshold up to €19,500, and flexible residency rules, balancing fairness with simplicity....

Cyprus offers a favorable tax environment for self-employed individuals, featuring a high personal income tax exemption threshold (€19,500), progressive rates, manageable social insurance contributions (16.6%), and access to public healthcare through GESY; understanding these systems ensures compliance while maximizing benefits....

The Cyprus-US Tax Treaty, signed in 1984, aims to prevent double taxation and tax evasion for individuals and businesses operating between the two countries by providing clear guidelines on income taxation. Key provisions include defining permanent establishment, determining residency criteria,...

Moving to Cyprus from the UK post-Brexit involves understanding new visa and residency requirements, local laws on property and taxation, language considerations, cost of living differences, and navigating work or business opportunities....

Understanding the tax system in Cyprus is essential for financial planning, as it includes income tax with progressive rates, social insurance contributions from both employees and employers, a Special Contribution for Defense on certain incomes, and General Healthcare System (GHS)...

The article explains the taxation of interest income in Cyprus, distinguishing between active and passive interest income. Active interest is taxed at a corporate rate of 12.5%, while passive interest incurs a Special Defence Contribution (SDC) of 17%, with certain...

The Tax Office Cyprus is essential for ensuring tax compliance and smooth financial operations in the country, covering direct taxation, VAT, and taxpayer services. This guide provides an overview of its structure, functions, key legislation governing taxes, filing procedures, and...