Table of Contents:

Introduction: Why Consider Tax-Free Living in Cyprus?

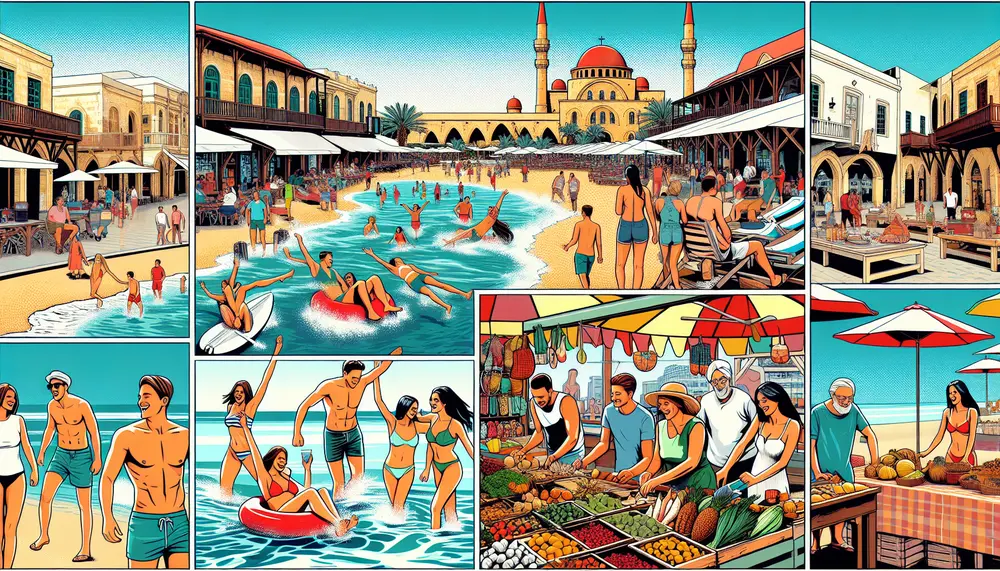

Cyprus has become a popular destination for those seeking to benefit from tax-free living. This Mediterranean island offers a unique combination of favorable tax policies, beautiful landscapes, and a high quality of life. For individuals and businesses alike, the advantages of living in Cyprus can be substantial.

One of the main reasons to consider Cyprus is its attractive tax regime. The country provides various tax incentives, including low corporate tax rates and exemptions on certain types of income. These benefits make Cyprus an appealing option for entrepreneurs, retirees, and high-net-worth individuals.

Additionally, Cyprus is part of the European Union, which means it offers stability and access to a large market. The island also boasts a well-developed infrastructure, excellent healthcare, and a pleasant climate. All these factors contribute to making Cyprus an ideal place for those looking to optimize their tax situation while enjoying a high standard of living.

The Basics of Tax-Free Cyprus

Understanding the basics of tax-free Cyprus is essential for anyone considering a move to this Mediterranean gem. Cyprus offers a range of tax benefits that make it an attractive destination for both individuals and businesses.

First, Cyprus has a territorial tax system. This means that residents are only taxed on income earned within Cyprus, not on income from abroad. This can result in significant tax savings for those with international income streams.

Second, Cyprus has double tax treaties with over 60 countries. These treaties help to avoid double taxation, ensuring that you don't pay tax on the same income in two different countries. This is particularly beneficial for expatriates and international businesses.

Third, the country offers various tax exemptions and deductions. For example, there are exemptions on certain types of foreign income, such as dividends and interest. Additionally, Cyprus provides generous deductions for expenses related to business activities.

Finally, Cyprus has a non-domicile (non-dom) status for individuals. This status allows non-domiciled residents to be exempt from taxes on dividends, interest, and rental income earned outside Cyprus. This makes it an ideal location for high-net-worth individuals looking to minimize their tax liabilities.

In summary, the basics of tax-free Cyprus revolve around its territorial tax system, double tax treaties, various exemptions, and non-dom status. These elements combine to create a highly favorable tax environment for residents.

Pros and Cons of Tax-Free Living in Cyprus

| Aspect | Pros | Cons |

|---|---|---|

| Tax Regime | - Low corporate tax rate of 12.5% - Exemptions on dividend and interest income for non-domiciled residents |

- Necessity to meet residency requirements |

| Quality of Life | - Beautiful landscapes - Pleasant climate - High quality of life |

- Potential cultural and language barriers for expatriates |

| Business Environment | - Numerous incentives for businesses - Double tax treaties with over 60 countries |

- Bureaucracy and administrative requirements |

| Healthcare | - Well-developed healthcare system - Access to both public and private healthcare options |

- Understanding of local healthcare regulations and policies required |

| Infrastructure | - Excellent infrastructure - Modern facilities |

- Limited public transport options in some areas |

Who Can Benefit from Tax-Free Cyprus Living?

Cyprus offers a range of tax benefits that can be advantageous for various groups of people. Here’s a closer look at who can benefit from tax-free Cyprus living:

- Entrepreneurs and Business Owners: Cyprus provides a low corporate tax rate and various incentives for businesses. Entrepreneurs can benefit from reduced operational costs and a favorable tax environment, making it easier to grow and expand their ventures.

- Retirees: Cyprus is an attractive destination for retirees due to its warm climate and high quality of life. Additionally, retirees can benefit from tax exemptions on foreign pensions and other income sources, allowing them to enjoy their retirement without significant tax burdens.

- High-Net-Worth Individuals: Those with substantial assets and income streams can take advantage of Cyprus’s non-domicile status, which exempts them from taxes on dividends, interest, and rental income earned outside Cyprus. This can result in significant tax savings.

- Expatriates: Expats working in Cyprus can benefit from the country’s double tax treaties, which help avoid double taxation on their income. This ensures that they do not pay tax on the same income in both Cyprus and their home country.

- Digital Nomads: With the rise of remote work, digital nomads can benefit from Cyprus’s favorable tax regime while enjoying the island’s beautiful landscapes and vibrant culture. The territorial tax system means they are only taxed on income earned within Cyprus, not on their global earnings.

In summary, Cyprus’s tax benefits are particularly advantageous for entrepreneurs, retirees, high-net-worth individuals, expatriates, and digital nomads. Each of these groups can leverage the country’s favorable tax policies to optimize their financial situation while enjoying the many other benefits that Cyprus has to offer.

How to Establish Tax Residency in Cyprus

Establishing tax residency in Cyprus is a straightforward process, but it requires meeting specific criteria. Here’s a step-by-step guide to help you become a tax resident in Cyprus:

- Stay in Cyprus for at Least 183 Days: To qualify as a tax resident, you must spend at least 183 days in Cyprus within a calendar year. These days do not need to be consecutive, but they must add up to 183 days.

- Register with the Tax Authorities: Once you meet the 183-day requirement, you need to register with the Cyprus tax authorities. This involves filling out the necessary forms and providing proof of your stay, such as rental agreements or utility bills.

- Obtain a Tax Identification Number (TIN): After registering, you will receive a Tax Identification Number (TIN). This number is essential for all tax-related activities in Cyprus.

- Open a Local Bank Account: Having a local bank account is crucial for managing your finances and receiving income in Cyprus. It also serves as additional proof of your intention to reside in the country.

- Maintain Proper Documentation: Keep records of your time spent in Cyprus, including travel tickets, accommodation receipts, and any other relevant documents. These records may be required to prove your tax residency status.

Additionally, Cyprus offers a 60-day rule for those who do not meet the 183-day requirement. Under this rule, you can still qualify as a tax resident if you:

- Spend at least 60 days in Cyprus within the calendar year.

- Do not reside in any other country for more than 183 days.

- Have business or employment ties in Cyprus.

- Maintain a permanent residence in Cyprus, either owned or rented.

By following these steps and meeting the necessary criteria, you can establish tax residency in Cyprus and start enjoying the numerous tax benefits the country has to offer.

Types of Tax Benefits in Cyprus

Cyprus offers a variety of tax benefits that make it an attractive destination for individuals and businesses. Here are the main types of tax benefits in Cyprus:

- Low Corporate Tax Rate: Cyprus has one of the lowest corporate tax rates in the European Union at 12.5%. This low rate makes it an appealing location for businesses looking to minimize their tax liabilities.

- Dividend Income Exemption: Dividend income received by Cyprus tax residents is generally exempt from income tax. This benefit is particularly advantageous for investors and business owners who receive dividends from their investments.

- Interest Income Exemption: Interest income earned by individuals who are tax residents in Cyprus is also exempt from income tax. This exemption can result in significant tax savings for those with substantial interest income.

- Capital Gains Tax Exemption: Cyprus does not impose capital gains tax on the sale of securities, including shares, bonds, and other financial instruments. This exemption makes Cyprus an attractive location for investors and traders.

- Non-Domicile Status: Individuals who qualify for non-domicile status in Cyprus are exempt from taxes on dividends, interest, and rental income earned outside Cyprus. This status is particularly beneficial for high-net-worth individuals with international income streams.

- Personal Income Tax Benefits: Cyprus offers various personal income tax benefits, including tax deductions for contributions to social insurance, pension funds, and other approved schemes. Additionally, the first €19,500 of annual income is tax-free, providing further relief for individuals.

- Double Tax Treaties: Cyprus has double tax treaties with over 60 countries, which help to avoid double taxation on income earned in multiple jurisdictions. These treaties ensure that individuals and businesses do not pay tax on the same income in both Cyprus and another country.

These tax benefits make Cyprus an attractive destination for those looking to optimize their tax situation. Whether you are an entrepreneur, investor, or retiree, Cyprus offers a range of incentives that can help you minimize your tax liabilities and maximize your financial well-being.

General Tax Rates and Incentives

Understanding the general tax rates and incentives in Cyprus is crucial for anyone considering a move to this tax-friendly island. Here’s a breakdown of the key tax rates and incentives that make Cyprus an attractive destination:

Corporate Tax Rate: The corporate tax rate in Cyprus is a competitive 12.5%, one of the lowest in the European Union. This low rate provides significant savings for businesses operating in Cyprus.

Personal Income Tax Rates: Cyprus has a progressive personal income tax system. The rates are as follows:

- 0% on income up to €19,500

- 20% on income from €19,501 to €28,000

- 25% on income from €28,001 to €36,300

- 30% on income from €36,301 to €60,000

- 35% on income over €60,000

Special Defence Contribution (SDC): The SDC is a tax on certain types of income for Cyprus tax residents who are domiciled in Cyprus. The rates are:

- 17% on dividend income

- 30% on interest income

- 3% on rental income

However, individuals with non-domicile status are exempt from the SDC, providing significant tax relief.

Value Added Tax (VAT): The standard VAT rate in Cyprus is 19%. There are also reduced rates of 9% and 5% for specific goods and services, and a 0% rate for certain transactions, such as exports.

Incentives for New Residents: Cyprus offers various incentives to attract new residents, including:

- 50% Tax Exemption: For individuals earning over €100,000 annually, 50% of their income is exempt from tax for the first 10 years of employment in Cyprus.

- 20% Tax Exemption: For individuals earning less than €100,000 annually, 20% of their income (up to a maximum of €8,550) is exempt from tax for the first five years of employment in Cyprus.

These general tax rates and incentives make Cyprus an appealing destination for both individuals and businesses. By taking advantage of these favorable tax policies, you can optimize your financial situation and enjoy the many benefits of living in Cyprus.

Tax-Free Cyprus for Individuals

Cyprus offers numerous tax benefits for individuals, making it an attractive destination for those looking to optimize their tax situation. Here’s a detailed look at how tax-free Cyprus can benefit individuals:

Non-Domicile Status: One of the most significant advantages for individuals is the non-domicile (non-dom) status. Non-domiciled residents are exempt from taxes on dividends, interest, and rental income earned outside Cyprus. This status is particularly beneficial for high-net-worth individuals with substantial international income streams.

Personal Income Tax Exemptions: Cyprus provides several personal income tax exemptions that can result in significant savings:

- Foreign Pension Income: Individuals receiving foreign pensions can choose to be taxed at a flat rate of 5% on amounts exceeding €3,420 per year. Alternatively, they can opt for the standard progressive tax rates.

- First €19,500 Tax-Free: The first €19,500 of annual income is tax-free, providing relief for lower-income earners.

- 50% Tax Exemption for High Earners: New residents earning over €100,000 annually can benefit from a 50% tax exemption on their income for the first 10 years of employment in Cyprus.

- 20% Tax Exemption for Lower Earners: New residents earning less than €100,000 annually can benefit from a 20% tax exemption (up to a maximum of €8,550) on their income for the first five years of employment in Cyprus.

Capital Gains Tax Exemption: Cyprus does not impose capital gains tax on the sale of securities, including shares, bonds, and other financial instruments. This exemption makes Cyprus an attractive location for investors and traders.

Special Defence Contribution (SDC) Exemption: Individuals with non-domicile status are exempt from the Special Defence Contribution (SDC), which applies to dividend, interest, and rental income. This exemption provides significant tax relief for non-domiciled residents.

Double Tax Treaties: Cyprus has double tax treaties with over 60 countries, helping to avoid double taxation on income earned in multiple jurisdictions. These treaties ensure that individuals do not pay tax on the same income in both Cyprus and another country.

By taking advantage of these tax benefits, individuals can significantly reduce their tax liabilities and maximize their financial well-being while enjoying the many other advantages of living in Cyprus.

Tax-Free Cyprus for Businesses

Cyprus is not only attractive for individuals but also offers significant tax benefits for businesses. Here’s how tax-free Cyprus can benefit your business:

Low Corporate Tax Rate: One of the most compelling reasons to establish a business in Cyprus is its low corporate tax rate of 12.5%. This rate is one of the lowest in the European Union, providing substantial savings for companies operating in Cyprus.

Exemption on Dividend Income: Dividends received by Cyprus tax-resident companies from foreign subsidiaries are generally exempt from corporate tax. This exemption is particularly beneficial for holding companies and multinational corporations.

Capital Gains Tax Exemption: Cyprus does not impose capital gains tax on the sale of securities, including shares, bonds, and other financial instruments. This exemption is advantageous for investment firms and businesses involved in trading activities.

Intellectual Property (IP) Box Regime: Cyprus offers an attractive IP Box regime, which provides an effective tax rate of 2.5% on qualifying IP income. This regime is designed to encourage innovation and attract businesses involved in research and development.

Double Tax Treaties: Cyprus has double tax treaties with over 60 countries, which help to avoid double taxation on income earned in multiple jurisdictions. These treaties ensure that businesses do not pay tax on the same income in both Cyprus and another country.

Tax Deductions and Incentives: Cyprus provides various tax deductions and incentives for businesses, including:

- Deduction for Interest Expenses: Interest expenses incurred for the acquisition of fixed assets used in the business are deductible.

- Notional Interest Deduction (NID): Companies can benefit from a notional interest deduction on new equity, reducing their taxable income.

- Tax Relief for Losses: Business losses can be carried forward for up to five years, allowing companies to offset future profits against past losses.

Special Economic Zones: Cyprus has established Special Economic Zones (SEZs) that offer additional tax incentives and benefits for businesses operating within these zones. These incentives include reduced tax rates, customs duty exemptions, and streamlined administrative procedures.

By leveraging these tax benefits, businesses can significantly reduce their tax liabilities and enhance their profitability. Cyprus’s favorable tax regime, combined with its strategic location and well-developed infrastructure, makes it an ideal destination for businesses looking to optimize their tax situation and expand their operations.

Practical Steps to Enjoy Tax-Free Cyprus Living

To fully benefit from tax-free Cyprus living, you need to follow several practical steps. These steps will help you establish your residency and take advantage of the various tax benefits Cyprus offers:

- Determine Your Eligibility: Before moving to Cyprus, ensure you meet the criteria for tax residency. This includes spending at least 183 days in Cyprus within a calendar year or qualifying under the 60-day rule if applicable.

- Register with the Tax Authorities: Once you meet the residency requirements, register with the Cyprus tax authorities. This involves filling out the necessary forms and providing proof of your stay, such as rental agreements or utility bills.

- Obtain a Tax Identification Number (TIN): After registering, you will receive a Tax Identification Number (TIN). This number is essential for all tax-related activities in Cyprus.

- Open a Local Bank Account: Having a local bank account is crucial for managing your finances and receiving income in Cyprus. It also serves as additional proof of your intention to reside in the country.

- Apply for Non-Domicile Status: If you qualify, apply for non-domicile status to benefit from exemptions on dividends, interest, and rental income earned outside Cyprus. This status provides significant tax relief for high-net-worth individuals and those with international income streams.

- Maintain Proper Documentation: Keep records of your time spent in Cyprus, including travel tickets, accommodation receipts, and any other relevant documents. These records may be required to prove your tax residency status.

- Utilize Double Tax Treaties: Take advantage of Cyprus’s double tax treaties with over 60 countries to avoid double taxation on your income. Ensure you understand the specific provisions of the treaties that apply to your situation.

- Consult with a Tax Advisor: To navigate the complexities of the Cyprus tax system and maximize your benefits, consult with a local tax advisor. They can provide personalized advice and help you comply with all legal requirements.

By following these practical steps, you can establish your tax residency in Cyprus and enjoy the numerous tax benefits the country has to offer. Proper planning and documentation are key to ensuring a smooth transition and optimizing your financial situation.

Common Mistakes to Avoid

While Cyprus offers numerous tax benefits, it’s essential to avoid common mistakes that could jeopardize your tax-free status. Here are some pitfalls to watch out for:

- Failing to Meet Residency Requirements: Ensure you spend at least 183 days in Cyprus within a calendar year or qualify under the 60-day rule. Inadequate time spent in Cyprus can disqualify you from tax residency benefits.

- Inadequate Documentation: Keep thorough records of your time in Cyprus, including travel tickets, accommodation receipts, and utility bills. Proper documentation is crucial for proving your tax residency status.

- Not Registering with Tax Authorities: After meeting residency requirements, promptly register with the Cyprus tax authorities and obtain a Tax Identification Number (TIN). Failure to do so can result in penalties and loss of tax benefits.

- Overlooking Non-Domicile Status: If you qualify for non-domicile status, apply for it to benefit from exemptions on dividends, interest, and rental income earned outside Cyprus. Neglecting this can lead to unnecessary tax liabilities.

- Ignoring Double Tax Treaties: Take advantage of Cyprus’s double tax treaties to avoid double taxation on your income. Understand the specific provisions of the treaties that apply to your situation to maximize your benefits.

- Not Consulting a Tax Advisor: Navigating the Cyprus tax system can be complex. Consult with a local tax advisor to ensure compliance with all legal requirements and to optimize your tax benefits.

- Incorrect Reporting of Foreign Income: Ensure accurate reporting of foreign income to avoid penalties. Misreporting can lead to audits and potential loss of tax benefits.

- Failing to Maintain a Local Bank Account: A local bank account is essential for managing your finances and proving your intention to reside in Cyprus. Ensure you open and maintain a local bank account.

By avoiding these common mistakes, you can ensure a smooth transition to tax-free living in Cyprus and fully enjoy the benefits the country has to offer. Proper planning, documentation, and professional advice are key to maximizing your tax advantages.

Final Thoughts: Maximizing the Benefits of Tax-Free Cyprus Living

Cyprus offers a unique combination of favorable tax policies, beautiful landscapes, and a high quality of life. By understanding and leveraging the various tax benefits, you can significantly enhance your financial well-being. Here are some final thoughts on maximizing the benefits of tax-free Cyprus living:

- Plan Ahead: Proper planning is crucial for taking full advantage of Cyprus’s tax benefits. Ensure you meet residency requirements, maintain proper documentation, and understand the specific tax incentives available to you.

- Utilize Professional Advice: Consulting with a local tax advisor can help you navigate the complexities of the Cyprus tax system. They can provide personalized advice, ensure compliance with legal requirements, and help you optimize your tax situation.

- Stay Informed: Tax laws and regulations can change. Stay informed about any updates or changes to Cyprus’s tax policies to ensure you continue to benefit from the available incentives.

- Maintain Proper Records: Keep thorough records of your time spent in Cyprus, financial transactions, and any other relevant documentation. Proper record-keeping is essential for proving your tax residency status and avoiding potential issues with tax authorities.

- Leverage Double Tax Treaties: Take advantage of Cyprus’s double tax treaties to avoid double taxation on your income. Understand the provisions of the treaties that apply to your situation and ensure you comply with the necessary requirements.

- Optimize Non-Domicile Status: If you qualify for non-domicile status, make sure to apply for it and benefit from the exemptions on dividends, interest, and rental income earned outside Cyprus. This status can provide significant tax relief for high-net-worth individuals and those with international income streams.

By following these final thoughts and practical steps, you can fully enjoy the benefits of tax-free living in Cyprus. Whether you are an entrepreneur, retiree, high-net-worth individual, or digital nomad, Cyprus offers a range of incentives that can help you minimize your tax liabilities and maximize your financial well-being.

FAQs on Tax-Free Cyprus Living

What are the residency requirements for tax-free living in Cyprus?

To qualify as a tax resident in Cyprus, you must spend at least 183 days in Cyprus within a calendar year. Alternatively, you can qualify under the 60-day rule, which requires you to spend at least 60 days in Cyprus, have business or employment ties in Cyprus, maintain a permanent residence in Cyprus, and not reside in any other country for more than 183 days.

What is non-domicile status and how can I benefit from it?

Non-domicile status in Cyprus exempts you from taxes on dividends, interest, and rental income earned outside Cyprus. This status is particularly beneficial for high-net-worth individuals with substantial international income streams, providing significant tax relief.

What are the tax benefits for new residents in Cyprus?

Cyprus offers various tax incentives for new residents, including a 50% tax exemption for individuals earning over €100,000 annually and a 20% tax exemption (up to €8,550) for those earning less than €100,000 annually. Additionally, the first €19,500 of annual income is tax-free.

Do I need to open a local bank account in Cyprus?

Yes, having a local bank account is crucial for managing your finances and receiving income in Cyprus. It also serves as additional proof of your intention to reside in the country.

How can I avoid double taxation as a Cyprus tax resident?

Cyprus has double tax treaties with over 60 countries, which help to avoid double taxation on income earned in multiple jurisdictions. By understanding and utilizing these treaties, you can ensure that you do not pay tax on the same income in both Cyprus and another country.