Posts on the Topic Guides and Resources

Moving from Cyprus to Germany requires careful planning, including organizing essential documents and understanding legal requirements for a smooth transition. Key steps involve preparing travel papers, choosing transportation methods, registering upon arrival, and integrating into German society through language learning....

Cyprus features numerous abbreviations across various sectors, including politics (e.g., AKEL, DISY), economics (e.g., CB, GDP), and education (e.g., UCY, TEI), aiding efficient communication. Familiarity with these terms is beneficial for locals and newcomers alike to navigate the country's social...

The Cyprus Tax Self-Assessment system allows individuals and companies to independently declare income, promoting transparency while requiring awareness of deadlines and tax obligations. It targets both residents with various income types and businesses, emphasizing the importance of accurate reporting to...

The Cyprus Income Tax Law (Law 118(I)/2002) provides a flexible, modular framework for individual and corporate taxation, regularly updated to align with international standards. It clearly defines tax residency, income types, exemptions, and deductions while interacting closely with EU directives...

When choosing a Cyprus VPN, prioritize local server performance, privacy policies, bypass ability for restrictions, security features, and transparent speed claims. Top providers differ in specialized servers, dedicated IPs, usability, advanced add-ons, support quality, trial periods and transparency—so match your...

The Cyprus University in Frankfurt, an extension of the European University Cyprus, offers innovative academic programs tailored to global and European job markets while fostering interdisciplinary research, industry partnerships, and a supportive environment for international students. Located in Frankfurt's dynamic...

The legal framework for immigration detention in Cyprus, influenced by national laws and EU directives, aims to balance migration management with human rights but faces challenges like arbitrary detentions, insufficient individual assessments, overuse of absconding risks, and poor facility conditions....

The 2023 Cyprus Tax Law PDF is a comprehensive, English-language guide offering up-to-date tax regulations, practical insights, and compliance tools for individuals and businesses. It highlights key areas like corporate tax, VAT, international treaties, and sector-specific rules while emphasizing clarity...

The Cyprus-Malta Double Tax Treaty eliminates double taxation, promotes cross-border investments, and aligns with global tax standards to enhance fairness and transparency. It defines residency rules, income types like dividends and royalties, and ensures efficient taxation for businesses and individuals...

Cyprus offers a favorable tax environment for self-employed individuals, featuring a high personal income tax exemption threshold (€19,500), progressive rates, manageable social insurance contributions (16.6%), and access to public healthcare through GESY; understanding these systems ensures compliance while maximizing benefits....

The Cyprus Jump Wings symbolize elite airborne training, requiring exceptional physical fitness, mental resilience, and mastery of advanced parachuting skills. The rigorous program combines theoretical knowledge with practical exercises in challenging conditions to prepare candidates for high-stakes military operations....

Filing your 2023 tax return in Cyprus involves understanding updated regulations, using the mandatory TaxisNet platform for digital submissions, and preparing key documents like income proofs and expense receipts. Compliance with residency-based obligations ensures accuracy while leveraging deductions can reduce...

Cyprus offers a unique blend of career opportunities, vibrant culture, and Mediterranean lifestyle with growing industries like IT, finance, tourism, and renewable energy. Its strategic location, English-friendly job market, reasonable living costs, and excellent work-life balance make it an attractive...

Cyprus is an appealing destination for tax-free living due to its favorable tax policies, including a territorial tax system, double tax treaties, various exemptions, and non-domicile status. These benefits make it ideal for entrepreneurs, retirees, high-net-worth individuals, expatriates, and digital...

When visiting the Cyprus Police - Immigration Office in Limassol, ensure you have all necessary documents and check if an appointment is needed for a smooth experience. The office operates Monday to Friday from 07:30 AM to 02:30 PM at...

Cyprus Aliens and Immigration Law regulates the entry, stay, and exit of foreign nationals, outlining visa types, residency permits, citizenship options, and immigrant rights. Recent amendments aim to streamline processes for prospective immigrants seeking work or residence in Cyprus....

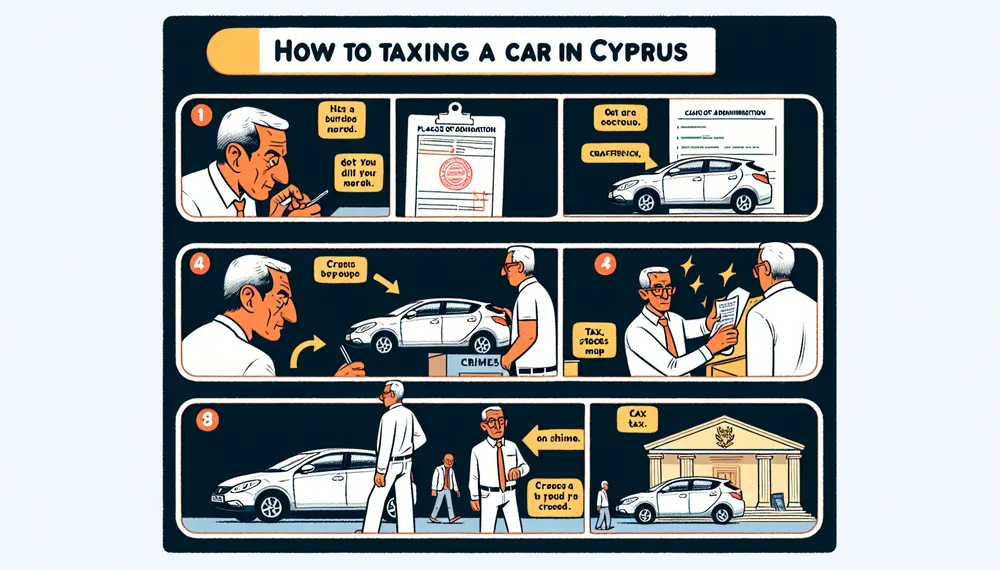

Cyprus license plates feature a structured format with letters indicating the registration district and vehicle type, alongside unique numbers for identification. Verification services are available to confirm vehicle details and compliance through online platforms....

The Cyprus Tax Exemption 55,000 offers expats significant tax relief by allowing them to exempt up to €55,000 from their taxable income, provided they meet specific residency and income requirements. This regulation simplifies tax planning for expatriates in Cyprus while...

Municipality tax in Cyprus funds local services and varies by area, calculated mainly on property value; payment methods include online portals and bank transfers....

Moving from Cyprus to Germany requires careful planning, including organizing essential documents and understanding legal requirements for a smooth transition. Key steps involve preparing travel papers, choosing transportation methods, registering upon arrival, and integrating into German society through language learning....

Cyprus features numerous abbreviations across various sectors, including politics (e.g., AKEL, DISY), economics (e.g., CB, GDP), and education (e.g., UCY, TEI), aiding efficient communication. Familiarity with these terms is beneficial for locals and newcomers alike to navigate the country's social...

EU citizens and their family members must apply for a residence card in Cyprus within four months of arrival, using forms MEU1 or MEU2, with a fee of 20 EUR. After five years of legal residency, they can apply for...

The 2023 income tax declaration for individuals in Cyprus requires taxpayers to adhere to updated procedures and deadlines, utilizing specific forms while being informed about deductions and credits available. The Tax Department offers support during business hours and online services...

Cyprus, strategically located in the eastern Mediterranean, boasts diverse landscapes and a rich cultural history, making it an appealing travel destination with unique contrasts. Its capital, Nicosia, is notable for being Europe's only divided capital, reflecting both historical tensions and...

In November, Cyprus offers mild temperatures around 21°C and fewer crowds, making it ideal for outdoor activities and exploration while enjoying the beautiful landscapes. Travelers can also enjoy swimming in relatively warm waters and experience local culture without the summer...

EU citizens can enter Cyprus without a visa using a valid passport or ID, but must apply for a registration certificate if staying longer than 90 days. It's essential to check health regulations and financial requirements before traveling....

When buying a used car in Cyprus, it's crucial to check the vehicle's history, conduct inspections and test drives, compare prices, and understand legal requirements. Choosing the right platform for purchase—whether online marketplaces or dealerships—can significantly impact your experience....

In 2023, Cyprus's population reached approximately 1.34 million, reflecting a growth of 1.02% driven by migration; however, challenges persist due to low fertility rates and an aging demographic....

Cyprus' history is shaped by various ruling powers due to its strategic location in the eastern Mediterranean, making it a target for conquests. Since 1914, these influences have significantly impacted the island's development....

The Cyprus Tax Self-Assessment system allows individuals and companies to independently declare income, promoting transparency while requiring awareness of deadlines and tax obligations. It targets both residents with various income types and businesses, emphasizing the importance of accurate reporting to...

Understanding Cyprus' visa policy is crucial for travelers, as EU citizens can enter without a visa while third-country nationals may need one based on their stay's duration and purpose. Various visa types exist, including short-stay and work visas, each with...

The Cyprus Tax Office is essential for tax collection and administration, operating Monday to Friday from 08:00 to 14:00, with various departments managing specific taxation areas. It provides resources online for taxpayers and professionals while promoting transparency and efficiency in...

Pakistani citizens seeking to immigrate to Cyprus must navigate specific visa requirements and processes, including applying for various types of visas based on their purpose. Understanding these regulations and available resources can enhance their immigration experience....

Attending a tax tribunal in Cyprus requires preparation, understanding the formal procedures, and having necessary documentation to effectively present your case. The tribunal aims for fairness with knowledgeable judges overseeing disputes between taxpayers and authorities....

A tax ruling in Cyprus is a binding, written statement from the Tax Department clarifying how specific transactions are treated under law, providing legal certainty and strategic planning benefits but limited to the applicant’s disclosed facts....

Understanding the Cyprus immigration stamp process is vital for travelers, as it involves entry and exit stamps that track residency status; proper documentation ensures a smooth experience. Various types of stamps cater to tourists, business visitors, students, and residents, each...

The article explains the correct pronunciation of "Cyprus" as /ˈsaɪ.prəs/, stressing the first syllable and using a diphthong followed by a schwa....

Cyprus offers a unique tax landscape with a low corporate tax rate of 10%, double taxation treaties, and no withholding taxes on certain payments, making it attractive for businesses. Engaging a local tax advisor is recommended to maximize these benefits...

To check a Cyprus VAT number online, use the EU’s VIES portal or the official Cyprus Tax Department website for fast, reliable verification and documentation....

Learning to identify Cyprus’s diverse snake species is essential for safety and enjoyment outdoors, with key features like head shape, eyes, color, and behavior aiding quick recognition....

The Nicosia Migration Department is centrally located at Archbishop Makarios III Avenue, 90, easily accessible by public transport and familiar to taxi drivers; contact can be made via phone, email, or fax, but parking is limited and appointments are often...

The Cyprus tax declaration deadlines for 2023 are strict, with key dates including July 31, 2024 (personal/self-employed), and late submissions incur automatic fines. The Tax Department operates Monday to Friday, 08:00–14:00; early preparation helps avoid penalties and last-minute stress....

Cypress knees are mysterious root structures unique to North American cypress trees, with their function still debated despite extensive research. They thrive mainly in saturated soils of the southeastern U.S., displaying diverse shapes and sizes that add intrigue to swampy...

The article explains how to correctly translate and use “Cyprus” (Zypern) in German for travel, research, politics, science, and everyday conversation....

The Cyprus Armed Forces, established after independence in 1960, have evolved into a conscript-based military focused on territorial defense and modernization while maintaining strategic independence through European partnerships....

The Cyprus–Switzerland Double Tax Treaty assigns taxing rights and reduces double taxation on specific income, with each country’s tax authority providing guidance. Indirect taxes like VAT are excluded, so direct communication with the relevant authorities is essential for compliance and...

The average gross annual salary in Cyprus is about 26,000 EUR, with significant variation by sector, experience, education level, and job location....

Cyprus Open University offers globally accessible, fully digital distance education with flexible programs and strong student support, but lacks traditional campus life....

Cyrus McCormick’s mechanical reaper, patented in 1834, revolutionized agriculture by dramatically increasing harvesting efficiency and enabling large-scale farming....

In 2023, the Cyprus Tax Department introduced new opening hours, digital contact methods, website improvements, updated tax legislation, and redesigned forms to streamline compliance....

Cyprus Ki Mudra is a beginner-friendly hand gesture rooted in Cypriot and Eastern traditions, promoting focus, emotional balance, and relaxation through simple practice....

Lebanese citizens must apply in person at the Cypriot embassy for a visa to move to Cyprus, meeting strict documentation and financial requirements....

Indian citizens must enter Cyprus only through official government-controlled airports or seaports, and several visa types are available depending on the purpose of visit....

Cyprus Zillow’s advanced search, filter, and map tools help users efficiently find properties that match their needs, but some listings lack detailed or historical data....

The Cyprus Income Tax Law (Law 118(I)/2002) provides a flexible, modular framework for individual and corporate taxation, regularly updated to align with international standards. It clearly defines tax residency, income types, exemptions, and deductions while interacting closely with EU directives...

Cyprus’s currency evolution reflects its complex history and identity, with each shift—from ancient coins to the euro—shaping trade, society, and economic stability. Understanding these changes offers practical insights into Cypriot life today....

Cyprus tax back allows non-EU tourists aged 16+ to reclaim VAT on personal goods bought from participating shops if exported in their luggage within three months. Strict eligibility rules apply, including a €50 minimum spend per transaction and original documentation...

When choosing a Cyprus VPN, prioritize local server performance, privacy policies, bypass ability for restrictions, security features, and transparent speed claims. Top providers differ in specialized servers, dedicated IPs, usability, advanced add-ons, support quality, trial periods and transparency—so match your...

Cyprus Xsolla fuels the local gaming ecosystem through strategic partnerships, industry events, and support for innovation, offering developers robust resources and global connections....

The Cyprus Stock Exchange offers beginners a transparent, digitally accessible platform with regulated and emerging markets, making investing efficient and flexible....

The Cyprus tax slab system features progressive rates, a zero-tax threshold up to €19,500, and flexible residency rules, balancing fairness with simplicity....

Proper preparation—including medical checks, insurance, paperwork, sun protection, and choosing a reputable dive center—ensures a safe and enjoyable first scuba experience in Cyprus....

Cyprus is uniquely divided into the internationally recognized Republic of Cyprus in the south and the Turkish Republic of Northern Cyprus, only acknowledged by Turkey. This division reflects contrasting political systems, cultures, and economies while preserving distinct identities shaped by...

The Cyprus Kennel Club (CKC) is the official authority for purebred dogs in Cyprus, offering internationally recognized registration and upholding FCI standards. CKC ensures pedigree authenticity, supports breeders and owners with resources and events, but requires thorough documentation and has...

The Cyprus Tax Calculator Exness provides instant, up-to-date net income estimates tailored to expats and residents, simplifying complex tax calculations....

Cyprus immigration fees vary by application type, must be paid in person with cash or card, and include extra costs like medical exams and document translations....

The Cyprus University in Frankfurt, an extension of the European University Cyprus, offers innovative academic programs tailored to global and European job markets while fostering interdisciplinary research, industry partnerships, and a supportive environment for international students. Located in Frankfurt's dynamic...

Cyprus Tax Authority circulars are essential tools that clarify tax laws, address ambiguities, and provide guidance for compliance and financial planning. They help taxpayers navigate complex regulations, reduce uncertainty, foster transparency, and optimize their tax strategies effectively....

The legal framework for immigration detention in Cyprus, influenced by national laws and EU directives, aims to balance migration management with human rights but faces challenges like arbitrary detentions, insufficient individual assessments, overuse of absconding risks, and poor facility conditions....

The 2023 Cyprus Tax Law PDF is a comprehensive, English-language guide offering up-to-date tax regulations, practical insights, and compliance tools for individuals and businesses. It highlights key areas like corporate tax, VAT, international treaties, and sector-specific rules while emphasizing clarity...

The Cyprus-Malta Double Tax Treaty eliminates double taxation, promotes cross-border investments, and aligns with global tax standards to enhance fairness and transparency. It defines residency rules, income types like dividends and royalties, and ensures efficient taxation for businesses and individuals...

Cyprus offers a favorable tax environment for self-employed individuals, featuring a high personal income tax exemption threshold (€19,500), progressive rates, manageable social insurance contributions (16.6%), and access to public healthcare through GESY; understanding these systems ensures compliance while maximizing benefits....

The Cyprus Jump Wings symbolize elite airborne training, requiring exceptional physical fitness, mental resilience, and mastery of advanced parachuting skills. The rigorous program combines theoretical knowledge with practical exercises in challenging conditions to prepare candidates for high-stakes military operations....

Filing your 2023 tax return in Cyprus involves understanding updated regulations, using the mandatory TaxisNet platform for digital submissions, and preparing key documents like income proofs and expense receipts. Compliance with residency-based obligations ensures accuracy while leveraging deductions can reduce...

Long-term rentals in Cyprus provide cost-effective, flexible housing options that allow residents to immerse themselves in local culture and enjoy the island's diverse lifestyle. Popular locations like Limassol, Paphos, and Larnaca cater to various preferences, offering amenities such as pools...

In 2022, Cyprus introduced significant tax changes focusing on transparency and compliance, extended filing deadlines for taxpayers' convenience, and emphasized the importance of transfer pricing documentation to align with international standards....

Cyprus offers a unique blend of career opportunities, vibrant culture, and Mediterranean lifestyle with growing industries like IT, finance, tourism, and renewable energy. Its strategic location, English-friendly job market, reasonable living costs, and excellent work-life balance make it an attractive...

The Cyprus Presidency involves significant responsibilities, including shaping national policies and international relations, with the President acting as a key diplomat and decision-maker in both domestic governance and global diplomacy....

Cyprus, located near the boundary of African and Eurasian tectonic plates, experiences frequent earthquakes necessitating preparedness such as securing furniture and having emergency plans....

The Cyprus Tax Department's JCC Smart System is an online platform designed for convenient, secure tax management and payments, offering comprehensive services like real-time updates on tax laws....

Cyprus International University in Northern Cyprus offers a vibrant, multicultural environment with diverse academic programs and flexible learning options, supported by generous scholarships and innovative research opportunities....

Cyprus highway speed limits are set at a maximum of 100 km/h and a minimum of 65 km/h to balance safety with traffic flow, while urban areas have a limit of 50 km/h and rural roads 80 km/h....

Cyprus offers a competitive and enticing tax system with progressive income tax rates, corporate incentives, no inheritance tax, and special regimes like Non-Dom status to attract individuals and businesses....

Cyprus offers a tax-friendly environment with low corporate tax rates, no inheritance tax, and strategic incentives like the Non-Domicile Status and IP Box Regime, making it attractive for individuals and businesses seeking to optimize their taxes....

Studying in Cyprus can be affordable, with many universities offering tuition-free undergraduate education for local/EU students and various financial aid options available; however, non-EU students typically face varying fees depending on the program....

The article provides a comprehensive guide on applying for Cyprus residence permits, detailing the types of permits available (temporary and permanent), their specific requirements, and the application process. It aims to simplify the steps involved, ensuring applicants understand what is...

The article provides a comprehensive guide to understanding and converting Cyprus time, which follows Eastern European Time (EET) during standard time and Eastern European Summer Time (EEST) during daylight saving. It also offers tools for managing these conversions effectively, ensuring...

Choosing between Cyprus and Crete for a vacation involves comparing factors like climate, beaches, culture, cuisine, and cost. Both islands offer unique experiences: Cyprus is ideal for sun-seekers with its hot summers and clear waters, while Crete offers diverse terrains...

Cyprus, an island in the Eastern Mediterranean, has a complex history marked by division due to historical events and nationalist movements among Greek and Turkish Cypriots. The 1974 conflict escalated with a coup d'état followed by Turkey's military intervention, leading...

Cyprus University, established in 1989 and located in Nicosia, offers a diverse range of programs with instruction primarily in Greek but also available in Turkish and English. Renowned for its commitment to quality education and research, it ranks 368th globally...

This guide provides comprehensive information on obtaining a Cyprus visa, detailing who needs one, the types of visas available, required documents, and the application process. It covers various categories such as tourist, business, student, work, transit, and family reunification visas...

Understanding the tax free minimum in Cyprus, set at €19,500 for 2023, is crucial for effective financial planning as it helps individuals know how much of their income is exempt from taxation. This threshold benefits employees, self-employed individuals, pensioners, and...

The article provides a comprehensive overview of the key tax aspects in Cyprus, covering income tax, corporate tax, capital gains tax, VAT, and inheritance tax. It highlights various rates, exemptions, and benefits available to individuals and businesses while emphasizing the...

Cyprus is an appealing destination for tax-free living due to its favorable tax policies, including a territorial tax system, double tax treaties, various exemptions, and non-domicile status. These benefits make it ideal for entrepreneurs, retirees, high-net-worth individuals, expatriates, and digital...

Top 10 posts in the category

Unsere Beiträge zum Thema Guides and Resources

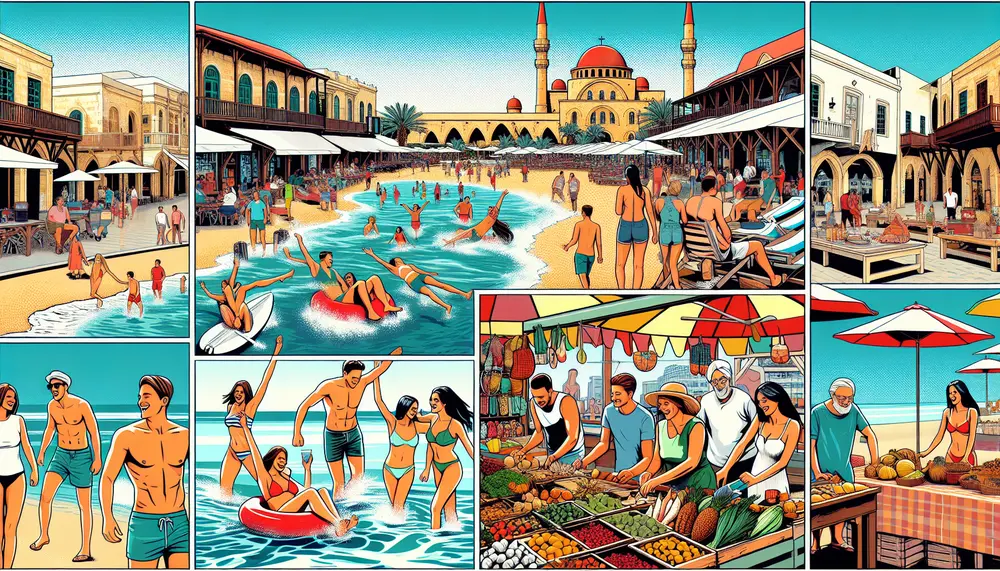

Explore the ultimate Guides and Resources on Cyprus to make the most out of your visit. Our comprehensive collection provides detailed insights into the island's rich history, breathtaking landscapes, and vibrant culture. Whether you're a first-time traveler or a seasoned explorer, our guides and resources are tailored to meet all your needs.

Get access to insider tips, practical advice, and local recommendations that will enhance your experience. Find everything from the best accommodation options and dining spots to hidden gems and must-see attractions. Our guides cover various aspects, ensuring you have all the information you need at your fingertips.

Our Guides and Resources section is designed to be user-friendly and informative. Each article is crafted by experts who possess in-depth knowledge of Cyprus, ensuring that you receive accurate and useful information. Save time and effort by relying on our well-researched content to plan your perfect escape.

Delving into our guides means gaining a deeper understanding of the cultural heritage, local customs, and modern developments of Cyprus. Whether you are looking to relax on pristine beaches, explore ancient ruins, or immerse yourself in local festivities, our resources will guide you every step of the way.

By using our Guides and Resources, you ensure a memorable and enriching journey. Make informed decisions and discover all that Cyprus has to offer with confidence and ease. Start your adventure now by browsing through our extensive collection of articles tailored just for you.