Posts on the Topic Taxation

The 2023 Cyprus Tax Law PDF is a comprehensive, English-language guide offering up-to-date tax regulations, practical insights, and compliance tools for individuals and businesses. It highlights key areas like corporate tax, VAT, international treaties, and sector-specific rules while emphasizing clarity...

The Cyprus-Malta Double Tax Treaty eliminates double taxation, promotes cross-border investments, and aligns with global tax standards to enhance fairness and transparency. It defines residency rules, income types like dividends and royalties, and ensures efficient taxation for businesses and individuals...

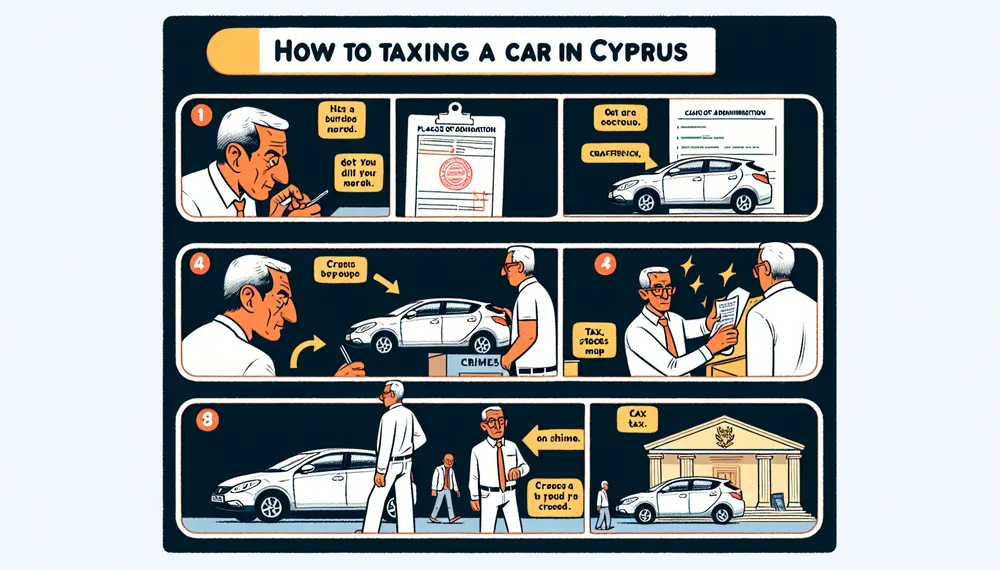

Filing your 2023 tax return in Cyprus involves understanding updated regulations, using the mandatory TaxisNet platform for digital submissions, and preparing key documents like income proofs and expense receipts. Compliance with residency-based obligations ensures accuracy while leveraging deductions can reduce...